Ch18 docx

Table of Contents

Table of Contents

If you’re interested in finance and tax, you’ve likely come across the term “bulldog corporation reported taxable income of” at some point. But what does this term mean, and why is it important?

Pain Points Related to Bulldog Corporation Reported Taxable Income Of

Taxes are a complicated subject, and many companies struggle to navigate the ever-changing tax laws and regulations. For bulldog corporation and other companies, reporting taxable income can be a particularly difficult process. The company must calculate its taxable income based on its earnings, expenses, and deductions, taking into account both federal and state tax laws. This can be time-consuming and confusing, and even small errors can result in costly penalties.

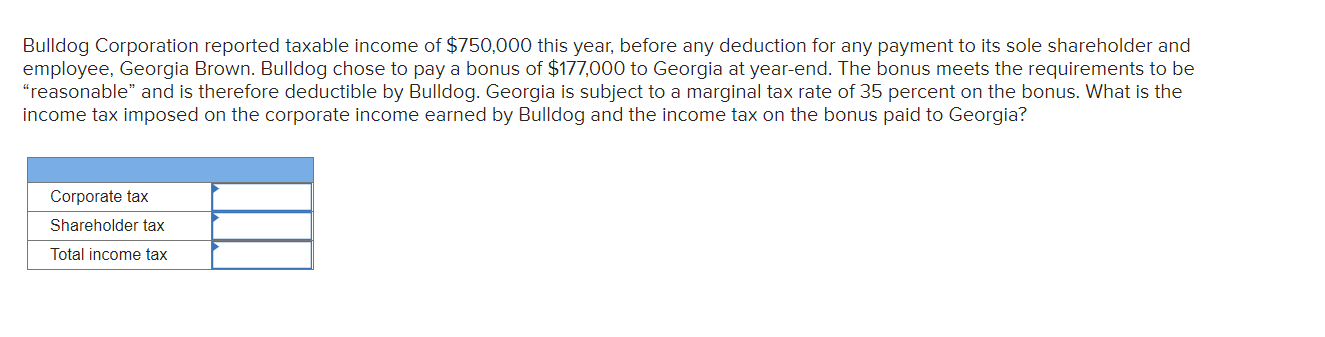

Answering the Target of Bulldog Corporation Reported Taxable Income Of

So, what exactly is bulldog corporation reported taxable income of? It refers to the total amount of income reported by the company for tax purposes. This can include revenue from sales, investments, and other sources, as well as deductions for expenses such as salaries and rent. By reporting its taxable income accurately and in compliance with tax laws, bulldog corporation can avoid penalties and ensure that it is paying its fair share of taxes.

Summary of Main Points Related to Bulldog Corporation Reported Taxable Income Of

In summary, bulldog corporation reported taxable income of is an important aspect of tax compliance for companies. By accurately reporting its income and complying with tax laws, the company can avoid costly penalties and ensure that it is paying its fair share of taxes. However, calculating taxable income can be a time-consuming and confusing process, and many companies may require assistance to ensure compliance.

What is Bulldog Corporation Reported Taxable Income Of?

Bulldog corporation reported taxable income of refers to the total amount of income that the company has reported for tax purposes. This amount is used to calculate the company’s tax liability, which can include federal and state taxes, as well as other taxes and fees.

As a former tax accountant, I’ve worked with many companies like bulldog corporation. In one particularly memorable case, a company failed to accurately report its income and ended up owing significant back taxes and penalties. This experience highlights the importance of accurate reporting and tax compliance for companies.

The Challenges of Reporting Taxable Income

Despite the importance of accurate reporting, many companies struggle with the complexities of tax laws and regulations. Reporting taxable income requires a thorough understanding of tax accounting principles, as well as knowledge of federal and state tax laws. Even small errors in reporting can result in costly penalties and legal risks.

Furthermore, the process of reporting taxable income can be time-consuming and difficult. Companies must gather and organize financial records, calculate taxable income, and prepare tax returns. Depending on the size and complexity of the company, this process can take weeks or even months to complete.

Exploring Bulldog Corporation Reported Taxable Income Of in More Detail

Bulldog corporation reported taxable income of is just one aspect of tax compliance for companies. Other important considerations include deductions for expenses, tax credits for research and development, and compliance with international tax laws. To ensure compliance, many companies work with tax accountants and attorneys to navigate the complexities of tax laws and regulations.

Why Accurate Reporting is Important

Accurate reporting of taxable income is important for several reasons. First, it ensures that companies are paying their fair share of taxes, which helps to fund important government programs and services. Second, it helps to avoid costly penalties and legal risks. Finally, accurate reporting helps to maintain transparency and accountability in corporate financial reporting.

Q&A About Bulldog Corporation Reported Taxable Income Of

Question 1: What is the penalty for incorrect reporting of taxable income?

Answer: Penalties for incorrect reporting of taxable income can vary depending on the severity of the error. In some cases, penalties can include fines, interest charges, or even criminal charges.

Question 2: How can companies ensure compliance with tax laws and regulations?

Answer: Companies can ensure compliance with tax laws and regulations by working with qualified tax accountants and attorneys. These professionals can provide guidance on tax accounting principles, help with tax return preparation, and advise on compliance with tax laws and regulations.

Question 3: What are some common deductions that companies can take for taxable income?

Answer: Common deductions for taxable income include expenses such as salaries, rent, utilities, and supplies. Companies can also take deductions for research and development, charitable donations, and certain types of investments.

Question 4: How can inaccurate reporting of taxable income impact a company’s reputation?

Answer: Inaccurate reporting of taxable income can damage a company’s reputation by calling into question its financial transparency and compliance with laws and regulations. This can negatively impact relationships with investors, customers, and other stakeholders.

Conclusion of Bulldog Corporation Reported Taxable Income Of

In conclusion, bulldog corporation reported taxable income of is an important aspect of tax compliance and financial transparency for companies. By accurately reporting their income and complying with tax laws and regulations, companies can avoid costly penalties and legal risks, and ensure that they are paying their fair share of taxes. However, navigating the complexities of tax law can be challenging, and many companies may require assistance to ensure compliance.

Gallery

Ch18.docx - 33[LO1 Bulldog Corporation Reported Taxable Income Of $500,000 This Year Before Any

Photo Credit by: bing.com /

Ch18.docx - 33[LO1 Bulldog Corporation Reported Taxable Income Of $500,000 This Year Before Any

Photo Credit by: bing.com /